At Contrast, we chose our name because our strategy and approach differ from those of many other issuers and fund managers.

The typical market strategy is built on chasing high-risk appreciation, which means success often requires substantial increases in value built on speculating future outcomes and timing market cycles. The motivation for this is simple: Investors are hoping for a quick, dramatic multiple on their capital based on recent and likely unrepeatable cycles (never mind being able to time the purchase and sale).

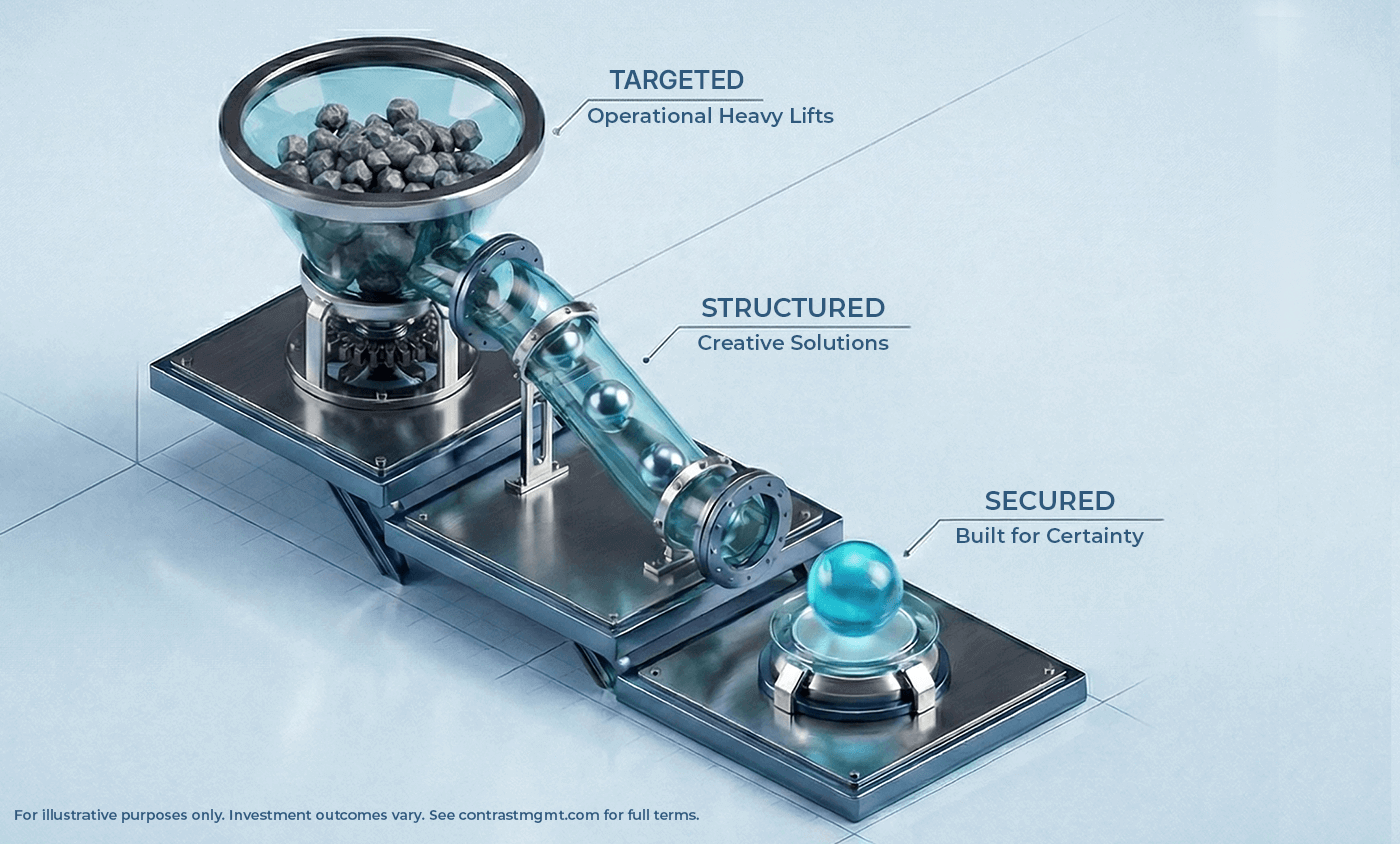

Contrast is built on the opposite premise: Certainty. The difference between speculation and our approach is defined by System and Probability. We are buying an income-producing business, not a commodity we are speculating will go up in value.

Our core distinction is a non-negotiable principle: Profit First. Commitment to Cash Flow First.

We only acquire properties where the income stream can support 100% of the expenses and debt service right now, with enough surplus to allow for 7% distributions. This is the operational standard that ensures our investors get paid every single month, regardless of market volatility.

The System of Trust: What is Real and Quantifiable

Trust is not a slogan; it is a PROVEN, QUANTIFIABLE SYSTEM.

Our commitment to cash flow is proven by the Three-Bucket Reserve Rule—the definitive financial process we follow before we close any deal. That’s what’s real.

We will not proceed to closing until we confirm we can fully fund these three distinct reserves:

- OPERATIONS RESERVE: Dedicated working capital for smooth, day-to-day property management.

- CAPEX RESERVE: Funds set aside for unexpected Capital Expenditures, protecting us from disrupting investor returns when major repairs and capital projects are required

- DEBT SERVICE RESERVE: The ultimate safety net, ensuring debt obligations are covered even if cash flow temporarily tightens.

This rule is the operational truth that Contrast is built for sustained profitability, not hype.

Managing Complexity: Our Stance on Tax and FX

For our cross-border investors, the complexity of filing foreign tax returns and managing Foreign Exchange (FX) fluctuation is a constant concern.

We address complexity by structuring deal vehicles (REITs, Trusts, LPs) to meet standard Canadian tax reporting requirements. Furthermore, we do not engage in tactical hedging. Contrast prioritizes long-term US Dollar stability. We ask one simple question:

Which currency has the best stability and long-term value?

We align with Institutional investors and managers who operate based on the premise that the US dollar is and will remain one of the most stable currencies globally. We simplify the

investment view to focus on what truly matters: the underlying cash flow.

Conclusion: The Process is the Product

We focus on PROVEN SYSTEMS. We believe in showing our work so investors see the process from purchase to stabilization.

Ready to explore the Contrast System? Follow Contrast for professional insights, or Contact Our Team to Learn More Today.